Data debt is killing GTM performance

How GTMEs can identify and dig out from the deficit

While engineering teams have long understood technical debt, go-to-market organizations are dealing with something equally destructive but far less recognized: data debt. Just as technical debt slows software development, data debt quietly sabotages your ability to identify, engage, and convert customers and prospects.

TL;DR

Data debt compounds as you scale, creating missed revenue opportunities along the way

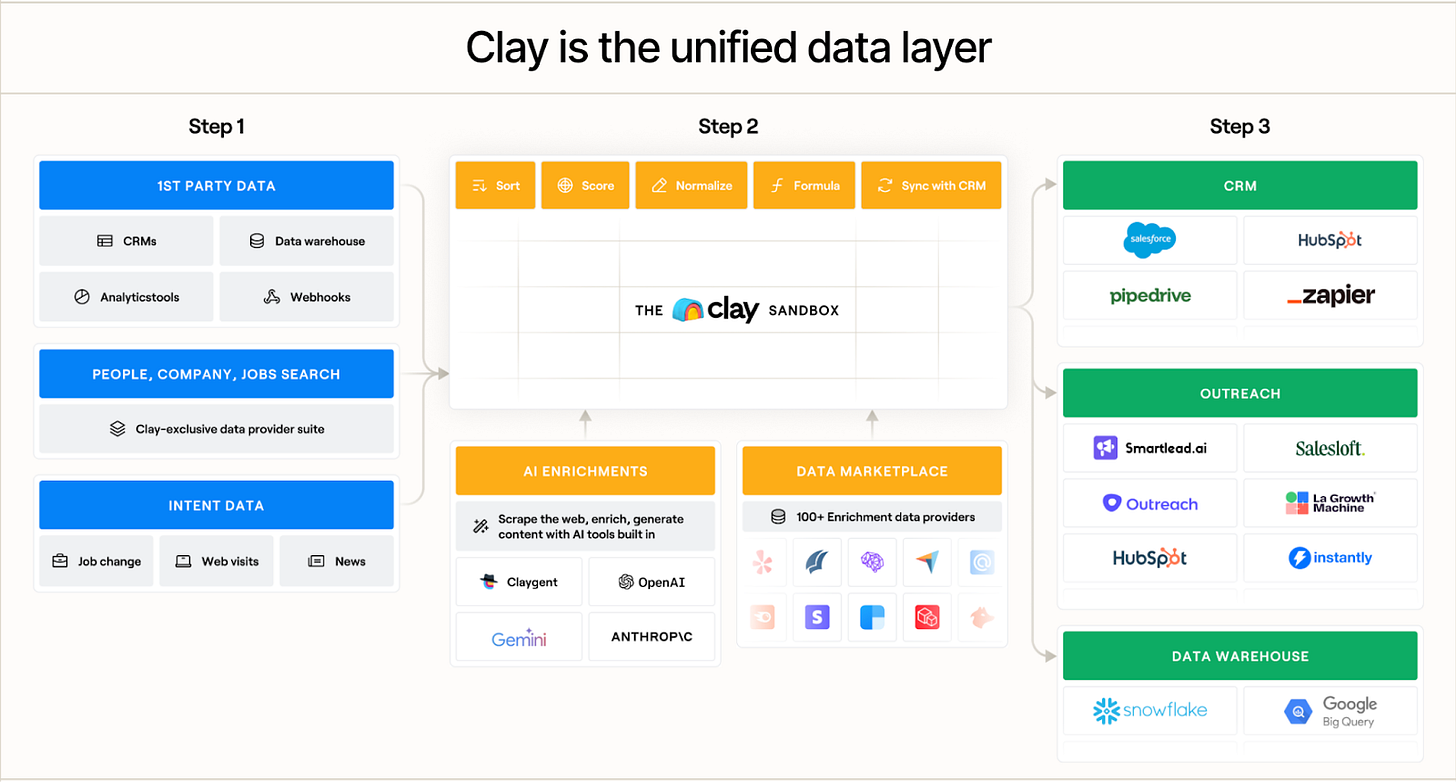

Solving data debt requires a unified approach to source, structure, and activate your revenue data

Clean data transforms from a burden into account intelligence that drives strategic advantage and helps your team find GTM alpha

Data debt costs more than you think

Data debt costs organizations strategic opportunities in ways that compound over time:

Sales teams spend up to 40% of their time on data research that should be automated. A rep making $150K can create a net loss of $60K annually in lost productivity due to data issues.

Marketing teams watch campaign performance tank as deliverability drops. When email bounce rates hit 15-20% due to bad data, your MQL pipeline collapses.

RevOps teams become janitors instead of strategists. They spend time cleaning data rather than optimizing revenue processes. The opportunity cost is massive.

Most teams don't even realize how much data debt is costing them, so they often delay action. By waiting, they put even more revenue growth at risk.

What data debt actually looks like

The signs of data debt are everywhere: you click on a contact to make a call, and they tell you "I left that job two years ago." Marketing campaigns bounce off dead emails. Millions of accounts and contacts sit in CRMs (yes, multiple!) but only a fraction are actually usable. RevOps teams spend 80% of their time on data cleanup instead of building intelligent account systems that drive revenue.

Data debt isn't just "messy data." It's the compound effect of poor-quality, ungoverned, and poorly catalogued data that builds up over time. Every quick fix, every tactical decision, every "let's just import this list" adds to the burden.

Here are the main sources of data debt:

Years of purchased lists: Companies buy lead lists to accelerate growth. These lists contain outdated, duplicate, or irrelevant contacts that never get properly validated. Each purchase adds thousands of unverifiable leads that pile up in your CRM.

Reps importing and exporting without validation: SDRs under quota pressure mass-import contacts from ZoomInfo, export to sequences, then import back to CRM—all without proper validation or deduplication. Sure, ZoomInfo claims high accuracy, but most teams I talk to see actual rates around 70% for accounts and 40-50% for contacts.

Manual data entry at scale: Sales reps create records on the fly, use inconsistent naming conventions, and develop workarounds like Googling "How many employees does [company] have?" to validate basic information. These manual processes fall apart at scale.

Duplicate records everywhere: The same prospect exists across multiple systems with slightly different information, making it impossible to get a single view of your pipeline or customer journey.

The integration multiplication effect: Every new tool—marketing automation, sales engagement, enrichment services—doesn't just add new data. It multiplies existing quality issues across every system. When you add bi-directional syncs between tools, you create doom loops where bad data gets worse as it spreads, and you lose track of where information originally came from.

How to solve data debt: Source → Structure → Activate

At Clay, we've seen this pattern repeatedly: companies with millions of contacts and accounts in their CRM, but less than 30% actually usable for revenue generation. This is both a data quality problem and a fundamental workflow problem.

The solution goes beyond just cleaning your existing data. You need to build a systematic approach to how data flows through your organization. We think about this in three key phases:

Source: Get the right data from anywhere

The cleanup process starts with sourcing. You need access to comprehensive data that matches your specific business model and requirements. This means connecting to your data warehouse, CRM, marketing automation platforms, and dozens of third-party enrichment providers simultaneously.

But here's the critical piece: your data model matters. For some companies, an "account" is a specific business entity. For others, an account represents a distinct business unit that makes independent buying decisions—you might have separate accounts for Netflix's finance department and marketing department because they buy differently.

Having access to diverse data sources changes how you approach data modeling because you're no longer constrained by what's available in a single system.

Structure: Transform data to fit your business

Once you've sourced the right data, you need to format it for your specific use case. This is where custom taxonomies become powerful. Instead of using broad, standardized industry categories like "healthcare" or "software," you can create your own classification system that actually reflects how your business views the world.

This structuring phase handles several key questions:

What format does this data need to be in to be useful?

How do we eliminate duplicates and standardize naming conventions?

What validation rules ensure data quality over time?

Activate: Put data to work where and when it's needed

The final phase is about getting the right data to the right people at the right time. This depends on who will use the data and how:

Real-time signals (like job changes or competitor mentions) need immediate alerts in Slack

Business intelligence and reporting data can be batch-processed since humans aren't looking at individual records

Sales and marketing data needs to live in your CRM with proper formatting for outreach

Clean, validated data flows back to any system of record—CRM, marketing automation, data warehouse—ensuring consistency across your entire tech stack.

The compound value of clean data

When data debt is eliminated, the benefits compound across three key areas:

Operations become strategic

RevOps teams transform from data janitors to strategic advisors. They can focus on pipeline analysis, conversion optimization, and revenue forecasting instead of constant data cleanup and validation. Implementing new tools becomes easier because you have a clean data model that everything can plug into.

Revenue impact accelerates

SDR teams shift from data sourcing to execution—no more time spent validating accounts or manually researching basic company information. Marketing teams can hyper-target with confidence, knowing their segments are accurate. Speed-to-lead improves dramatically because clean data enables automated lead routing without the risk of sending prospects to the wrong rep.

Customer experience elevates

Teams work with consistent, accurate information across all touchpoints. No more embarrassing emails to people who left the company months ago, or outdated information that kills trust. Every interaction is informed and relevant.

From data debt to account intelligence

Once organizations eliminate data debt, they can move beyond reactive data management to proactive account intelligence. This represents the next evolution of GTM data strategy, where teams go from fixing problems to finding competitive advantage.

This advanced approach focuses on two key capabilities:

Acting on signals faster: Clean data enables immediate responses to opportunities and changes. Whether it's competitor movement, job changes, or funding announcements, you can build automated workflows that alert the right people and trigger the right actions. Companies with clean data foundations achieve speed-to-lead advantages that directly impact conversion rates.

Better prioritization and targeting: With reliable data, you can understand which accounts are truly worthwhile and build systematic approaches to territory planning. This includes mapping account hierarchies to identify companies you can close based on existing relationships, tracking mutual investors for warm introductions, and building sophisticated TAM models that guide expansion efforts.

The result is account intelligence that drives strategic decisions rather than just reactive firefighting.

A special thanks to Clay’s own Dorothy Huynh for inspiring this piece and getting it kicked off.